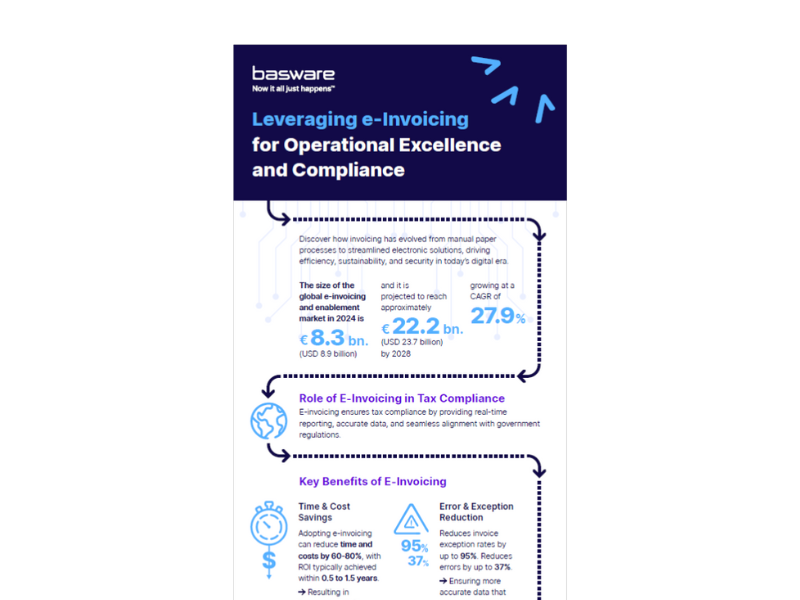

Compliance is no longer a back-office obligation — it’s a strategic advantage. And for businesses to compete on the global stage, they must treat it as such.

Basware’s research, conducted in collaboration with FT Longitude shows that organizations taking a centralized, modern approach to tax and invoice compliance are reducing risk, preventing fraud, and driving profitability. Leaders who treat compliance as a core business capability gain visibility, control, and competitive edge, setting the standard for intelligent, future-ready finance.

.jpg)