- Blog

- Death to Paper Invoices…Are We Serious?

Death to Paper Invoices…Are We Serious?

Death to paper and optical character recognition (OCR) processes – there, we said it! It's a pretty bold (and controversial) statement on our part, especially considering the current state of global invoicing. So, how can Basware state so blatantly that paper is soon to go the way of the fax machine? To better understand this, we need to understand why paper is still so prevalent today, despite all the money and effort spent on purchase-to-pay (P2P) automation.

Paper invoices no longer make financial sense

Now more than ever, businesses are realising that their payables processes are not up to par. Inefficient processes aren’t just resulting in late payments, fees, and strained supplier relationships – global supply chains are being impacted. The following issues lead to slow payments. According to CTMfile, more than 1 in 4 invoice payments are made late (27%). And according to Payments Journal, as many as 70% of all invoice processing globally is still paper-based, adding days and weeks to invoice processing worldwide.

Most Latin American countries have mandated e-invoicing to prevent tax fraud. Other countries have also mandated e-invoicing for business-to-government (B2G) processes (Germany, France, Italy, Spain, etc.), but the US, for example, has struggled to formalise such an e-invoicing mandate.

Out with OCR and in with SmartPDF and e-invoicing

The simple fact is that every business is looking for ways to streamline costly processes and do more with less. The challenge has been getting buyers and suppliers on the same page. Many traditional e-invoicing initiatives push a significant amount of change and cost to the supplier. Passing the burden on to the supplier is not a realistic method of pushing adoption of e-invoicing.

The majority of manual invoices today are received by e-mail. This has been a win-win for the buyer and supplier. The supplier does not have to pay for supplies and postage and receiving e-mail attachments is faster to process than physical mail for the buyer.

A large percentage of these e-mailed invoices are created by an accounting system (Quickbooks, Sage, Microsoft, Oracle, SAP, etc). But the nuance is – these systems also generate a readable PDF document and that's the game-changer. It's why Basware can make the bold statements that we have.

You see, readable PDFs have a structured text file embedded in the document – it's different than PDFs that are merely an image of the document. This is why you can copy text from the document and paste it to another file. Basware has created a solution that allows this data file to be read by the e-invoicing solution, mapped, and converted into a true e-invoice.

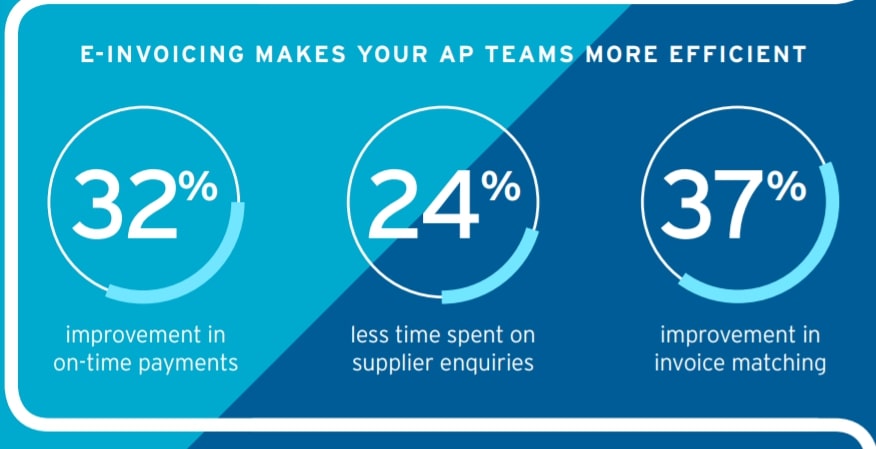

Now is the time for e-invoicing, SmartPDF, and Smart Coding. Electronic invoicing (e-invoicing) improves supplier relationships, increases automated matching rates, and provides the data needed for advanced and predictive analytics. But additional features such as Basware SmartPDF and Smart Coding add additional value.

SmartPDF eliminates manual work and decreases the risk of careless errors since nothing is manually printed, scanned, or re-entered. Instead, all the necessary invoice data is extracted from the readable PDF and automatically transferred into your AP or ERP system. The process can be broken down into 5 easy steps:

-

Invite your suppliers to use SmartPDF.

-

Your supplier sends PDF invoices via email to a dedicated email address.

-

Basware SmartPDF uses AI to determine if the PDF is a readable PDF or an image PDF.

-

Readable PDFs are sent through the Basware Network, converting the attachment into an e-invoice in near real-time, without OCR, data errors, or delays.

-

The extracted invoice data is delivered electronically into your AP or ERP system

Smart coding is another technology that uses machine learning to automate the handling of non-PO invoices and get one step closer to touchless processing. Using an advanced machine learning algorithm, Smart coding searches and analyses historical invoice data to recommend the proper general ledger code for non-PO invoices. The more you use the feature and the more data you have running through your system, the more accurate its recommendations are.

These technologies allow the supplier to send the same file they send you today – without changing anything about how they operate or paying any fees. The invoice can be processed, validated, and imported into your AP process without any human intervention, and in a matter of minutes.

So, yes – this means OCR will be replaced with readable PDFs and structured data because this technology actually makes it possible for buyers and suppliers to get on the same page.

Why is the death of paper invoices and OCR technology a win-win?

If I put myself in the shoes of a supplier for a minute, here is what I see:

-

My customer is asking me to send the same file I send them today.

-

I do not have to pay anything to do so.

-

I know my invoice is getting directly into my customers' approval process, and not sitting on a desk somewhere.

-

I can log into a portal at any time and see the status of my invoice (for free).

-

Now that I am sending something that my customer can process electronically, my invoice can be processed faster, leading to opportunities for dynamic discounts and early payment programs.

You can see how this becomes a simple solution for suppliers to say yes to.

On the buyer side, there are huge benefits as well. Lost invoices become less frequent (because they go straight into the AP process). Manual keying and OCR processes become irrelevant. Resources that once spent the day doing basic, repetitive tasks can be repurposed to focus on strategic themes such as removing bottlenecks, managing category spend, etc.

And then, of course there is the cost savings. Manually touching invoices costs time and money. Each paper invoice incurs approximately $20.82 for the buyer, $7.81 for the supplier, for a total cost of $28.63 for the entire process. Obviously, each company calculates the number differently, but none the less it is a major cost. The thought of reducing this is a major motivating factor!

So, what’s next – if not OCR and paper invoices?

Ok; we understand that paper and OCR will not be completely extinct soon. But most companies should be able to reduce paper to 3-5% of their total invoice volume.

We also understand that PDF e-invoicing is not a silver bullet. But when you can offer your suppliers more options to send invoices the way they want, adoption rates grow exponentially. Eliminating the change and cost a supplier faces is the key to moving from a paper-based process, and I am proud to say that is something that Basware does better than any other e-invoicing provider in the market.

Learn more about Basware AP Automation.

Related

-

By Basware RepresentativeAccelerate Your Business Growth with Basware AP Automation: Fast Track to Value

-

By Basware RepresentativeUnveiling CFO Strategies for Long-Term Value Creation – Webinar Insights

-

By Anu HämäläinenUnlocking the Power of AI in Finance: A Dive into Invoice Ingestion Revolution

-

By Christopher BlakeComplexity to Clarity: Forrester's Expert Take on AP Invoice Automation

-

By Anu HämäläinenThe Evolution from OCR: It's Time for a Change

-

By Christopher BlakeChoosing AP Excellence: Finding the Right Solutions Amid S2P Suite Challenges

-

By Basware RepresentativeUnlock the Power of Invoice Digitalization: Watch Our On-Demand Webinar Now!

-

By Daniela MerkWebinar: Moving Beyond Legacy Solutions - Embrace the AI-Powered Financial Revolution on October 11th!