- Blog

- How to Reduce Wasteful Spending by Aligning Finance & Procurement

How to Reduce Wasteful Spending by Aligning Finance & Procurement

Basware recently commissioned Forrester to conduct an independent analysis of the economic impact of our purchase-to-pay cloud solution. Read on to find out exactly how this study found a 307% ROI potential when organisations implemented Basware’s solution and aligned finance and procurement.

Last week, we hosted a webinar to explore the findings of the Forrester Total Economic Impact study. Guest speakers Sebastian Selhorst, Principal Consultant at Forrester, and Victor Nanni, E-procurement Manager at the Swedish Fortifikationsverket Agency and a client of Basware, joined me to share their insights. For those who couldn’t attend, this article shares what we discussed.

The Process: Forrester’s Total Economic Impact (TEI) Framework

To conduct the analysis, Forrester researchers applied their proprietary TEI framework to assess the benefits, costs and flexibility that a client experiences as a result of using Basware’s purchase-to-pay solution, filtered through the risks that the client is subject to. By accounting for risks, the framework errs on the conservative side, ensuring that clients don’t expect uncommonly high ROI.

As part of the analysis, Forrester interviewed five of Basware’s customers who are using the purchase-to-pay solution:

-

A hospitality company based in the U.S. and Canada with an approximate annual spend of €400M

-

A business services company based in Europe with an approximate annual spend of €450M

-

A commercial organisation based in APAC with an approximate annual spend of €90M

-

A government agency based in Europe with an approximate annual spend of €300M

-

A manufacturing company based in Europe with an approximate annual spend of €175M

The Landscape: Common Pain Points and Experiences

Forrester explored the clients’ experiences both before and after using Basware’s purchase-to-pay solution. They found that each of the clients began with many inefficient, manual and paper-based processes that were slowing them down. Uncontrolled spending was hindering profitability. And lack of visibility and disjointed processes across finance and procurement meant that they didn’t know how to improve their numbers.

All of the clients Forrester studied experienced a common set of benefits after using Basware’s purchase-to-pay solution. They all saw efficiency gains, cut invoice cycle times, improved visibility and increased the amount of spend under management.

The Global Head of Procurement and Knowledge Operation at the business services company said, “We actually measured and estimated our whole invoicing processing cost. We were calculating at the beginning our processing cost to be around €40 per invoice, and now we’re down to €22, calculating full labor cost and associated IT costs. We roughly lowered our invoice processing cost by 45%.”

The Composite Client

In order to come up with the average expected economic impact of using Basware’s purchase-to-pay solution, Forrester created a composite organisation to represent the average client. This composite client is a business services company with operations in four different countries and an average annual spend of €300M. Before the composite client begins working with Basware, they’re operating on a legacy accounts payable system, and they have no PO system. They generate 20,000 purchase orders per year and receive 100,000 invoices per year — 75% of which are paper.

The Findings: How to Reduce Wasteful Spending by Aligning Finance & Procurement

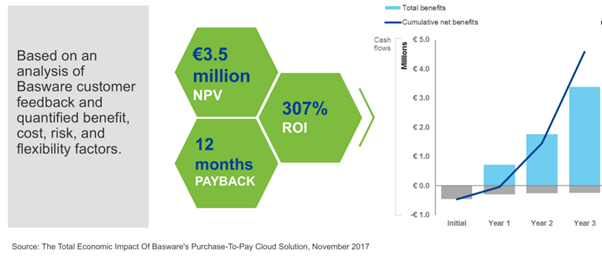

Based on their analysis of the feedback they received from Basware’s clients and the data they analysed (with the benefits, cost, risks, and flexibility factored in), Forrester found the following three-year impact, with the total cumulative benefits skyrocketing between Year 2 and Year 3.

-

A net present value of €3.5M

-

307% ROI

-

12-month payback period

Forrester found five important benefits that the average client can expect from Basware’s purchase-to-pay solution and more alignment between finance and procurement.

-

Spend Optimisation

More spend was directed to preferred suppliers for better tier pricing and the ability to enforce price compliance. The amount of spend under management increased from 30% to 60%. And the incremental cost savings was between 1%-3%. On average, the composite client saw spend optimisation-related savings of €3M over three years. -

AP Productivity Gains

The proportion of e-invoices went up, automatic matching meant fewer mistakes, and there were fewer supplier inquiries. AP staff was reduced from 16 to 9, and the composite client saved €748K on the AP side over three years. -

Early-Pay Discounts

The composite client decreased invoice cycle times due to automation, simplified process, and a higher proportion of e-invoices. The average early-pay discount was 1% and the client saw a savings of €472K over three years, due to early-pay discounts. -

End-User Productivity Gains

Automated matching and automated rules streamlined the approval of recurring invoices. The composite client saved an average of 1 hour per month per approver, resulting in a savings of €408K over three years. -

Maintenance Cost Savings

Thanks to retiring the legacy solution, the composite client saw a savings of €47K over three years.

A Real-Life Example: Fortifikationsverket’s Experience with Basware’s Purchase-to-Pay Solution

After Sebastian shared the results of Forrester’s research, Victor gave us an overview of the benefits his organisation has experienced using Basware’s solution over the last year. Fortifikationsverket is part of the Swedish Finance Department and is a real estate owner that purchases and builds properties for the Swedish government and armed forces. The organisation turns over 3.3 Billion SEK annually.

Fortifikationsverket receives over 100,000 invoices per year, so reducing unnecessary manual steps and reducing late fees were priorities. Mandated compliance was also a concern. Due to unreliable data, they struggled to create realistic budgets, so they needed to optimise their procurement resources and identify spikes in costs more reliably.

After one year of using Basware’s purchase-to-pay solution, Fortifikationsverket saw the following results:

-

A reduction of over 70,000 operating steps

-

Higher accuracy in contract adherence and on-time payments

-

Better and more reliable data

Now that their first year of using Basware’s solution, Sebastian predicts that his organisation will benefit further as they use the marketplace, access contracts directly within the solution, receive more invoices electronically, implement additional automation, and use data analytics to further optimise their resources.

Related

-

By Christopher BlakeComplexity to Clarity: Forrester's Expert Take on AP Invoice Automation

-

By Basware RepresentativeThe route to logistics software harmony for finance, AP and procurement

-

By Jeff Meredith7 Half-Truths Purchase-to-Pay Providers Are Telling You

-

By Katarzyna FonteynHow to create procurement visibility from day 1

-

By Basware RepresentativeRenaming the P2P Process – PN2P

-

By Basware RepresentativeRedefining P2P: Improving Your Purchasing Strategy

-

By Basware RepresentativeIntegrating Procure-to-Pay and ERP Systems

-

By Magnus BergforsFutureproofing your S2P Strategy - Solution Ecosystem vs. Single Suite