- e-Invoicing Compliance News Blog

- Basware Helps LatAm Businesses Stay Compliant with Global e-Invoicing Mandates

Basware Helps LatAm Businesses Stay Compliant with Global e-Invoicing Mandates

Electronic invoicing is no longer a trend – it’s the norm. With the spread of e-invoicing surging across the globe, with it comes a myriad of laws, mandates, and new electronic invoicing (e-invoicing) compliance requirements. Read to learn about the history of Latin America’s e-invoicing journey and how Basware helps businesses stay compliant with their mandates concerning e-invoicing and archiving.

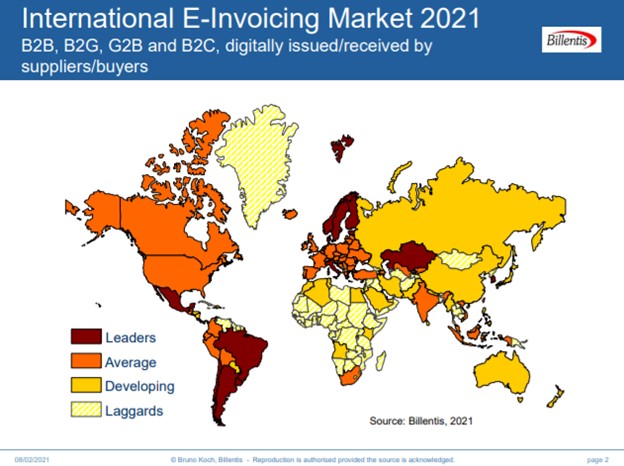

Across the globe, countries are turning more and more towards e-invoicing. Why? Because the benefits speak for themselves. E-invoicing drastically reduces the cost of processing an invoice, decreases the likelihood of invoice disputes, eliminates manual entry errors, increase global tax compliance overall, and reduces the reliance on paper processing and therefore, creates a greener more sustainable workplace.

E-invoicing is here to stay. While in the past, developments on the topic have largely been pushed by the private sector, there is an ongoing and notable shift towards governments driving the adoption of e-invoicing during the past years.

This can particularly be observed within Latin America. Basware has been working with e-invoicing services in Latin America since 2011. Even before this, many of our global customers have been using Basware Procure-to-Pay (P2P) solutions and Basware CloudScan within their Latin American subsidiaries in order to automate their Accounts Payable (AP) processes.

Latin America’s e-invoicing journey

Since Basware does not have a local presence in Latin America, we work together with local partners to perform the necessary tasks needed to create and/or receive and archive e-invoices in a compliant way. Our customers can enable e-invoice sending and receiving through a single service in all Latin American countries where there is an e-invoicing mandate.

Even though Latin America is often referred to as one region when it comes to e-invoicing, the maturity of e-invoicing differs country by country. Chile was the first country to introduce e-invoicing in Latin America back in 2003 although the model was not yet mandatory at the time.

Today Argentina, Chile, Brazil, Ecuador, Mexico, Peru, and Uruguay all have introduced mandatory e-invoicing and together with Nordic countries they can be considered as advanced e-invoicing markets. Costa Rica and Colombia are also well on their way after introducing mandatory e-invoicing in 2019. A key driving factor for these e-invoicing mandates across the region is the prevention of tax fraud.

In all these mentioned countries, the e-invoicing models can be considered "clearance models" where the invoice sender needs to deliver (and register or “clear”) the invoice with the local tax administration before it can be sent to the actual invoice receiver. Typically, the invoice also needs to be validated upon reception via a tax admin interface, but this is not available in all countries (e.g. in Argentina). So, although the models share many characteristics, they also differ from each other. Managing the local peculiarities of each model is a complex task requiring significant resources and potentially a large number of different service providers.

In Latin America, we use partners to enable Basware’s e-invoice receiving customers to:

-

receive and validate the invoices in the local format,

-

manage the validation interface with a tax administration platform when available,

-

archive the documents in the local format,

-

identify and proactively prevent tax fraud,

-

convert the invoice data to Basware Network core format or to customer specific data format,

-

and manage the delivery to customer AP/ERP system.

On top of meeting local e-invoicing requirements Basware can deliver a full suite of services (including Scan and Capture, CloudScan, PDF e-Invoice, Basware Portal) to capture 100% of supplier invoices regardless of supplier capabilities and preference. Basware uses this well proven approach (local partner for local clearance invoices + Basware's global solutions for import/export invoices) in all clearance markets where there is an e-invoicing mandate in place.

Since these so called “clearance models” bring significant benefits from a tax collection point of view in countries with a significant VAT gap, Basware expects that this trend will continue to grow, and we will see new e-invoicing mandates in the upcoming years in an ongoing effort to continuously prevent tax fraud situations.

Basware helps overcome compliance challenges

If you’re an organisation who operates or does business with companies in Latin America (or anywhere in the world for that matter), Basware’s e-invoicing solution helps assist you with all your compliance challenges from identifying obligations and assessing requirements to designing and managing solutions and keeping track of all the changes in the regulatory environment.

For years, Basware has been gathering regulatory and best practice knowledge from local markets, building new format conversions, connecting locally authorised compliance partners and tax authorities, and enabling the use of digital signatures and certificates. With this all under our belt, we can support your global, covering both B2B and B2G connectivity.

As a global market leader in e-invoicing, Basware is a strong partner to consider for your global e-invoicing compliance requirements. No matter your needs, Basware helps you cover all e-invoice delivery channels.

We provide a single source for global compliance by providing support in over 60 countries through our 200+ interoperability partners. We deliver multi-channel coverage combined with localised knowledge and connectivity to third parties.

So, how is it that we can provide all this for organisations worldwide? For starters, we’ve partnered up with the leading e-invoicing and tax compliance advisers and service providers, as well as with various local partners, to ensure our business network supports our customers for compliant e-invoicing where it’s needed the most. On top of that, Basware’s in-house compliance management works together with our service management team and with external advisers and authorities to maintain and improve the compliance support provided by the Basware Network.

Our network and its country coverage are growing constantly, ensuring organisations like yours with compliance support. This frees organisations from the burden and complexity of global compliance and lets you focus on what matters.

As we discussed earlier, complying with global invoicing and tax mandates is complex and the consequences of non-compliance can be severe. But with Basware, you can automate your e-invoicing to assist with compliance across all B2G and B2B mandates that include different formats, processes, and archiving standards. Basware supports you in your VAT compliance work in more than 50 countries and a certified PEPPOL access point.

Efficiency, compliance, and control – thanks to automation

At the end of the day, e-invoicing compliance isn’t easy. But when you let the experts support you, you gain efficiency, compliance, and control.

Efficiency

-

Reduce the costs associated with handling global tax compliance.

-

Free resources from a large part of the burden and complexity of e-invoicing compliance to focus on core business.

Compliance

-

Minimise errors by providing up-to-date tax information.

-

Reduce the risk of financial penalties and other sanctions associated with non-compliance with regulations.

Control

-

Comprehensive audit trails including original invoice image to provide control over the entire process.

-

Secure data transfer and additional security measures throughout the process.

(For Basware's entire statement on how we assist with global compliance, view our General Compliance Notice on Basware Services here.)

Read further blogs about e-invoicing compliance

“Let the pros help with global e-invoice compliance” - When it comes to keeping up with invoicing compliance, operations are further complicated by their global nature. But there is one clear way to simplify compliance with worldwide requirements – automation.

“Be prepared for France’s 2023 e-invoice mandate” - Read to learn how to be prepared for France’s comprehensive e-invoice mandate which will come into force in 2023.

“Germany’s new B2G e-invoice mandate for suppliers: ensuring compliance from day one” - Xrechnung, Leitweg-Id & Peppol: What matters & how to be compliant.

“Basware Network Ensures Compliance with India’s new National e-invoice Mandate 2020” - The Indian government is now taking the next step to ensure the nation’s tax compliance. This blog explains in detail what the mandate entails, who will be affected by it, and how Basware helps your organisation to stay compliant in the Indian market.