- Blog

- 3 Changes Automation Will Bring to Finance and Procurement (And How to Prepare)

3 Changes Automation Will Bring to Finance and Procurement (And How to Prepare)

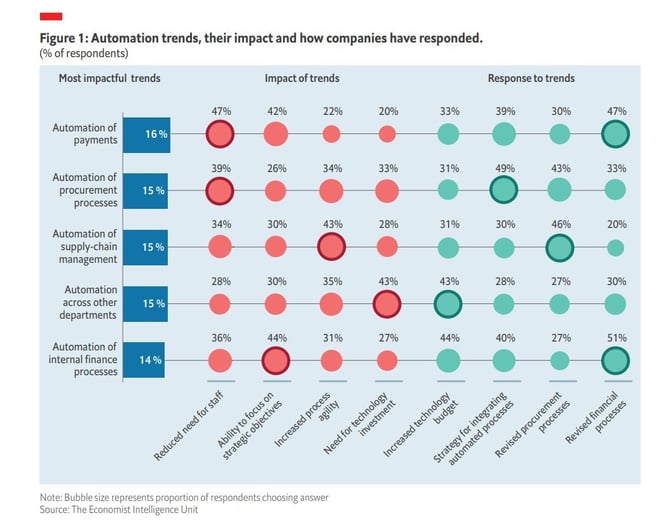

In the recent EIU report, sponsored by Basware, respondents stated that they expect the automation of payments, procurement processes and supply-chain management to have the greatest impact on their organisations in the next two years. Here’s what changes they’re expecting and how they’re preparing.

Humanity has always had an interesting relationship with machines. In the first industrial revolution, steam was king, propelling steam-engine trains, agricultural equipment, and textile productions. In the second revolution, mass production assembly lines, airplanes, and gasoline-powered engines developed. In the third, we created computers and eventually transferred analog functions into internet-based ones.

And now? We’re well into a fourth industrial revolution. Artificial intelligence (AI), neurotechnology, and all the automated, techy things that make Smart Homes what they are. And this fourth revolution is affecting more than just our day-to-day lives—it affects how we do business.

The Future of an Automated Workplace

Forrester Research found that by 2021 robotic automation technology will accomplish the same amount of work as almost 4.3 million human beings worldwide. This has huge implications for workers and employers equally.

Forrester’s research isn’t alone in its findings, either. The Economist Intelligence Unit, sponsored by Basware, interviewed over 400 finance and procurement executives in the US, the UK, France and Germany. From those discussions, the EIU wrote a report What’s now and next for procurement and finance. The surveyed executives gave input as to how they’re preparing for the 3 global macrotrends predicted to affect finance and procurement over the next 2 years: automation, digitisation, and global trade trends.

And although organisations cannot readily predict the future of business, they can be on the forefront and adopt those inevitable changes that automation will bring to procurement and finance.

3 Ways Automation will Affect Finance and Procurement

1 – Automation of procurement and finance processes

Respondents to the EIU survey report believe that the automation of various finance and procurement processes are going to have the biggest impact on their organisations day-to-day. When asked which automation trend would have the greatest impact over the next 2 years, respondents selected "automation of payments." Many companies have experienced this already: the sheer amount of invoices in our customer organisations are automatically processed for payment without anyone being part of the payment process. Since all the checks and approvals have been made in advance, payments happen seamlessly.

2 - Automation across other business departments

Automation of procurement processes, supply-chain management, and automation across other business departments were deemed the second most important automation trend. But these types of automation aren’t expected to affect more intellectually based processes such as supply chain or procurement decision-making. However, we see that predictive analytics is stepping in for almost every higher-level task. Whether you are a business leader forecasting material and service needs to run your business, or a R&D manager deciding which suppliers to buy from, there is a solution to help in the decision-making. Just as there is predictive analytics for Shared Services leader and treasurer to predict when purchase orders are converting to cash needs.

3 – Change in business functions

As technology has done throughout history, new automation trends are bound to change how we do business. The most likely trend we will see as a result of a more automated workplace is a reduced need for staff. As buyers are advised of the probability of their purchase requisition getting approved, or as they are informed of the likeliness of their invoices getting paid late, they have to think what actions to take today to create the most value for the company. This needs collaboration with other people and critical thinking outside their own area of influence – something human beings are particularly good at. Automation of manual processes will open the door for newer career paths—those that build on the strengths of more strategic, more human way of thinking.

Preparing for an Automated Future

How are finance and procurement departments preparing for the coming wave of automation? Here are the most common preparations survey respondents are taking:

-

Increasing technology budgets (39%)

-

Mapping out a strategy for integrating automated processes (37%)

-

Revising procurement management processes (35%)

-

Revising finance management processes (34%)

-

Recruiting specialist talent in preparation (25%)

It’s hard to say which of these preparations will prove to be the most effective. But, according to the EIU report, there are a few precautions that confident executives are taking (and your organisation should, too). 46% of organisations who feel prepared for this next wave of automation have increased their technology budget compared to 26% who don’t feel as confident. And 43% of confident executives have mapped out a strategy for integrating automation processes versus 18% who aren’t. (Click to tweet this stat!)

Benefits of Automation

Automation is set to drastically change how the workplace operates. With automated finance and procurement processes (as well as all the steps in between), your organisation will generate and gain access to valuable high-quality information produced at each step of your purchase to pay (P2P) process. With all the data flowing through automated process, you’ll have 100% spend visibility across your entire organisation, offering opportunities to reduce or eliminate maverick spend and right-size your supplier base.

In the accounts payable side, an automated invoice handling process contributes to reduced cycle times, quicker supplier payments with ability to capture available discounts, and reduced supply chain risk. Automation of the P2P process also provides opportunities to ensure regulatory compliance, and reduce exceptions and errors. And, with reduced manual work, your users are happier too!

Ready to learn more?

Read more about how industry leaders are preparing for the future of procurement and finance by reading the full EIU report. Questions? Contact us! We’re here to help.

Related

-

By Basware RepresentativeThe route to logistics software harmony for finance, AP and procurement

-

By Katarzyna FonteynA Reflection on the State of Procurement

-

By Katarzyna FonteynHow to create procurement visibility from day 1

-

By Basware RepresentativeDon’t Delay Digital Procurement & Finance Investments

-

By Ann StrömbergNordic Leaders Circle focused on procurement development

-

By Katie ColbourneProcure-to-Pay Trends Predictions and Advancements for 2022 and Beyond

-

By Basware RepresentativeBasware to Help Expand e-Invoicing with the Business Payment Coalition

-

By Ann StrömbergProcurement Collaboration, Resilience, Technology, and Sustainability